We are always looking at the market data. Housing prices fluctuate every year. Sometimes, month-to-month swings can be seen if a major event happens in the news. But usually, price adjustments are more identifiable on a quarterly basis. Recently, we were looking at some properties in the State and thought it would be helpful to share some of what we have noted. (Please note; this data is straight out of the Connecticut SMART MLS system.)

Median Sales Price vs Average Sales Price

We use the Median Sales Price as our indicator for price sensitivity and adjustments by market and property type. The reason we don’t use Average Sales Price is that the average price can be heavily influenced by properties sold at a high price or very low price. Well, if you’re looking at a market that has had more foreclosures (sold at heavy discount) or has that one neighborhood that skews higher than the others – the Average Price could be a false indicator.

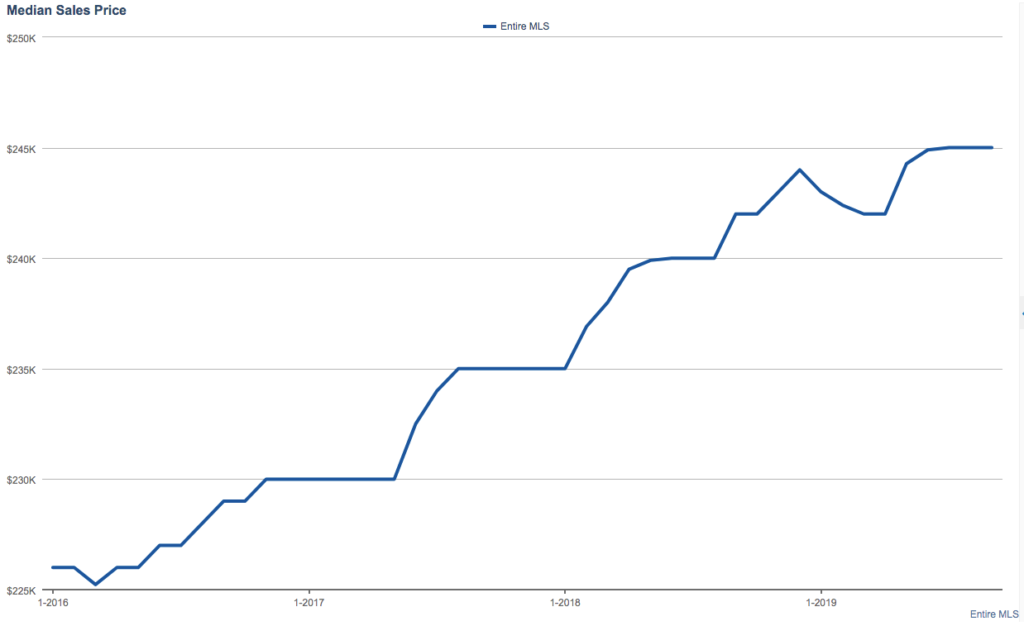

Take a look at the State of Connecticut. Median Price for a Single Family Home with 3 Bedrooms, 1.5-2.0 Bathrooms and is 1500-2000 square feet in size. This is pretty much mainstream housing and represents a lot of the closed sales for the county.

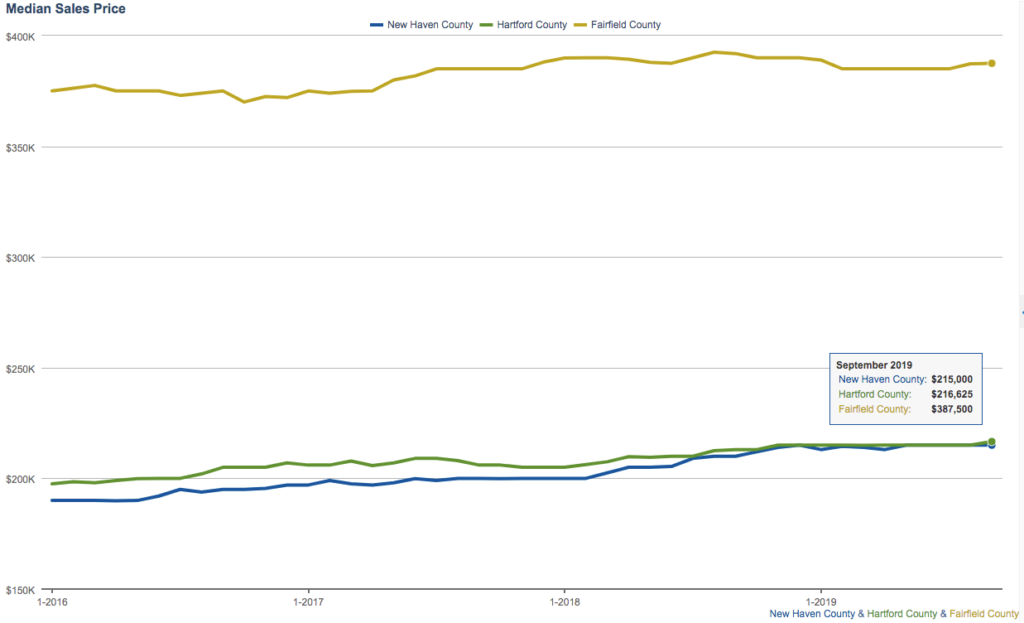

Looking at a Median Sales Price of $245,000 for the entire State of Connecticut. Overall, over the past few years, the Median Price for these types of homes (described above) has increased. Now, take a look at the same home type profile as compared to New Haven, Hartford, and Fairfield counties. (These counties represent the majority of home purchases in the State.)

Impact on Buying Decisions

If you plan to purchase a 3 Bedroom, 1.5-2.0 Bathroom, 1500-2000 square foot home in either Hartford or New Haven county, you can expect to pay something in the $220,000 range. Of course, there are more expensive homes and cheaper homes. But that’s the point of the Median Sales Price. Now, the same home in Fairfield county will cost you ~43% more.

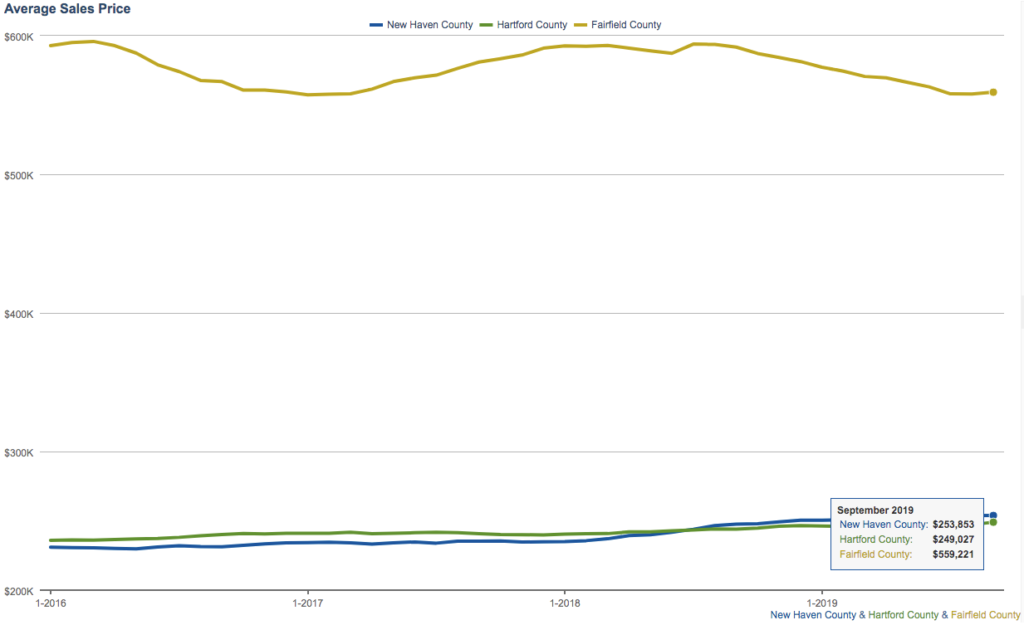

Just as a side note; if you were to consider the same housing profile for the same counties but as an Average Sales Price reference – here’s how it would look:

The average price for New Haven county is $253,000 while Hartford is $249,000. And Fairfield is staggering $599,000.

Applying the Market Data

So, how does all this apply to our business? Why would we study this? Well, the answer is really simple. We have to be aware of how Buyers will perceive the market they are looking into and whether or not the market has affordable AND desirable homes to purchase. So, there’s the balancing act (for us). To acquire properties that we can renovate and still put back on the market at a near market median/average price point. If we exceed what the market (more specifically, the neighborhood) warrants for a price – we lose money.

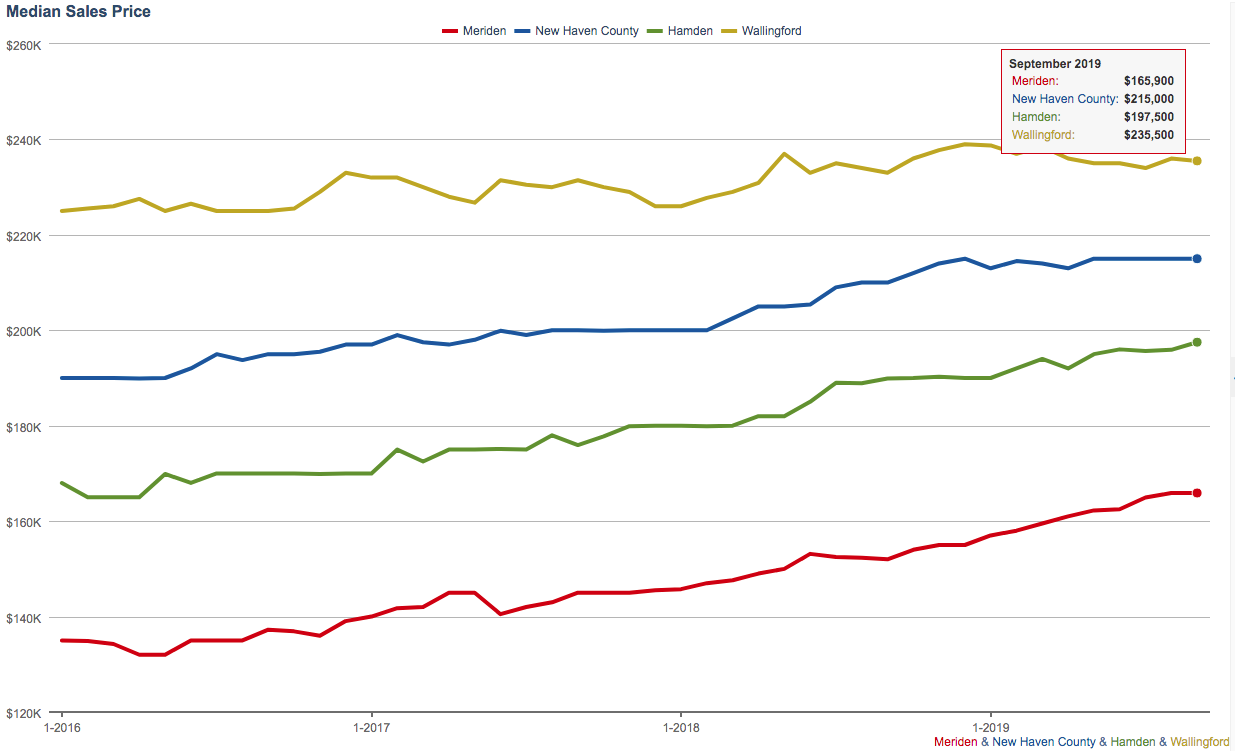

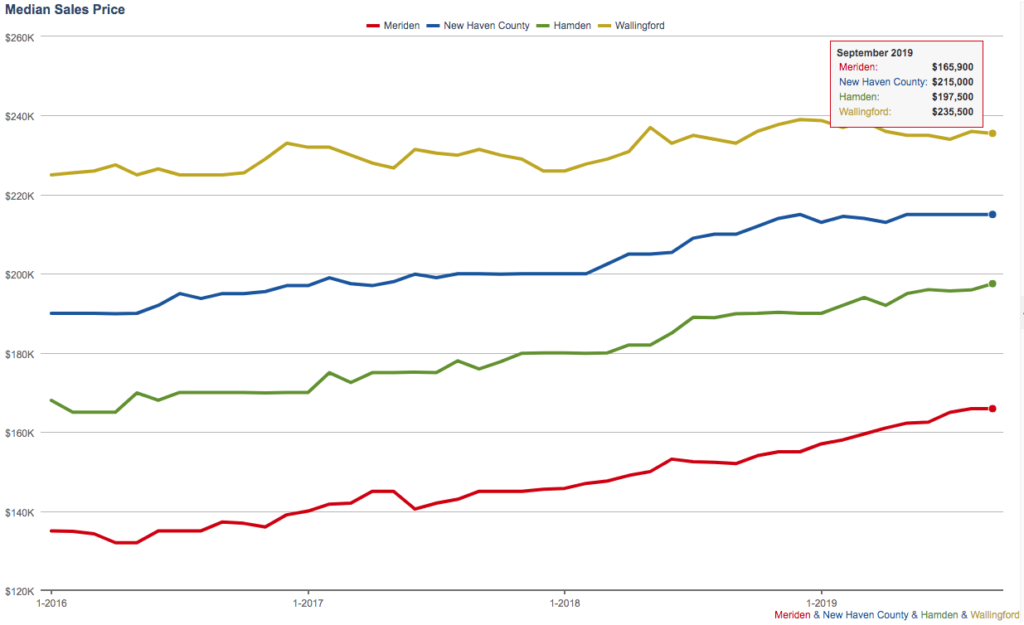

So, let’s take this one step further because the County-level data is only directional. It’s not specific enough to help us make a decision. Once we evaluate the data at a County level, we then take the same evaluation down to the town level. Here’s an example within New Haven County and the towns of Hamden, Wallingford, and Meriden.

Clearly, Wallingford is closer to the Median Sales Price of New Haven county compared to Hamden or Meriden. So, this tells us two things. First, if we look at buying a property for $100,000 in any of these three towns, our chance of a profitable return is better in Wallingford. But, second, it also tells us that there are areas in Wallingford that have highs and lows that will further impact that purchase price. Remember, the Median Sales Price is going to represent the median number of all sales. Speaking of sales, let’s look at the number of closed sales in the same County and Town view.

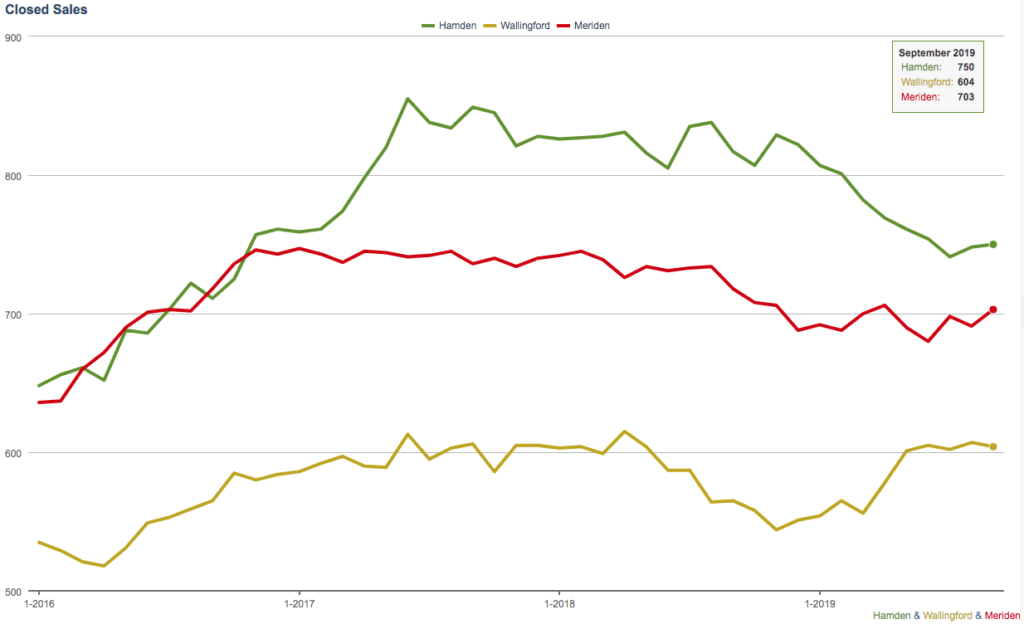

These three towns profile pretty close to each other in terms of Closed Sales. What does this tell us? Well, each of these towns is comparable in terms of total sales. It just means that there is good activity and that people are looking actively at each town to consider a purchase based on their buying criteria.

Factoring other Market Data Points

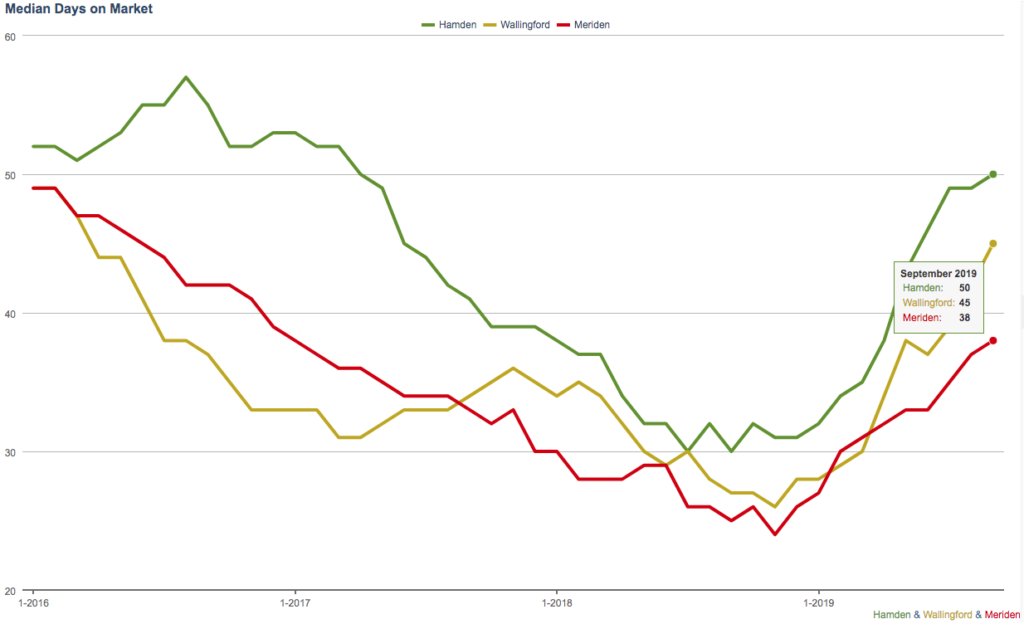

But there are many attributes we consider aside from price and activity. For example; we need to know what the Average Days on Market are for each town. One important note; Meriden sells much faster in comparison to Hamden and Wallingford.

So, now we know that a 3 bedroom, 1.5-2.0 bathroom 1500-2000 square foot house in Wallingford bought at $100,000 would have a Median Price value of $235,000 but it would take an additional 12 days to sell compared to Meriden.

Okay, so that’s the basic math to help us isolate a town for profitability. Once we know the pricing, inventory activity and the days on market we can start to really refine our efforts on a town. Let’s stick with the Wallingford example. Our next focus will be to dive into the differences by home type, size, bedrooms and bath count. We will compare the zoning of the town to compare sales by neighborhoods and residential zoning.

Real Estate Investment Company

As a real estate services company that invests in the housing market, if we only looked at the towns that have good pricing – we’re not including the whole picture. Remember how Fairfield county has an Average Sales Price of $599,000? Believe me, we’re not buying a house for $100,000 that is going to be renovated and sold for $600,000. But, if we can acquire a house (with possible resale value in the $600k+ range) for $250-$300k with maybe $150k in renovations – that’s a deal worth considering.

Point is, it all boils down to knowing the market, understanding the math and being able to execute a solid renovation plan. There are always issues, but if you have systems (like we do) for managing these things – the issues are something that you manage. Not something you react to.

Well, that’s a blog for another day.

I could go on for pages and pages talking about the market metrics. If you’re interested to know how we evaluate a property and want to discuss being an investment partner – give me a call at 203-486-8868.

Thanks,

g.